Want to save this page as a pdf?

Looking for something specific on the page?

Try pressing CTRL + F keys on your keyboard to bring up an on-page search.*Note: This functionality is dependent on the browser type and version you are using.

This is a digital resource and is not intended for reference outside of the URL: https://eappannuitywiki.fglife.com/

Table of Contents

Support

Appointment Process

Requirements for Appointment

To begin the contracting process, you must obtain an agreement from either a Managing General Agent or one of our field representatives. The agreement you receive will depend upon the level of your committed production. This section will outline all agreements, how to complete them and other forms necessary for appointment.

Learn more about agent appointmentSystem Requirements for e-App

As long as you can access, send and receive emails from the email account you have provided to us in your insurance application, you will need the following minimum computer hardware and software minimum requirements:

Recommended Browsers:

- Google Chrome

Supported Internet Browsers:

- Microsoft Internet Explorer, Version 9+

- Microsoft Edge Latest Release

- Reduced functionality with Microsoft Internet Explorer, Version B

- Annotations within the application are disabled

- Click-wrap signature support only

- Pie charts within Review Queue are disabled

- Minor visual changes to the user interface

- Mozilla Firefox Latest Release

- Google Chrome Latest Release

- Safari Version Latest Release (the Windows version of Safari is not supported)

- iPad tablet running iOS7+

- Tablets running Android OS 4+

System Requirements:

- Internet Access

- Minimum Screen Resolution 1024×768

- 128MB RAM

- Cookies and JavaScript Enabled

System Access/Logging In

To start an e-App, you must first log in to SalesLink. To log into SalesLink you must be appointed with F&G. Once appointed you will be given a nine-digit agent code. If you do not have this agent code, please contact your IMO or our contracting department. Once you have your code, log in to SalesLink.

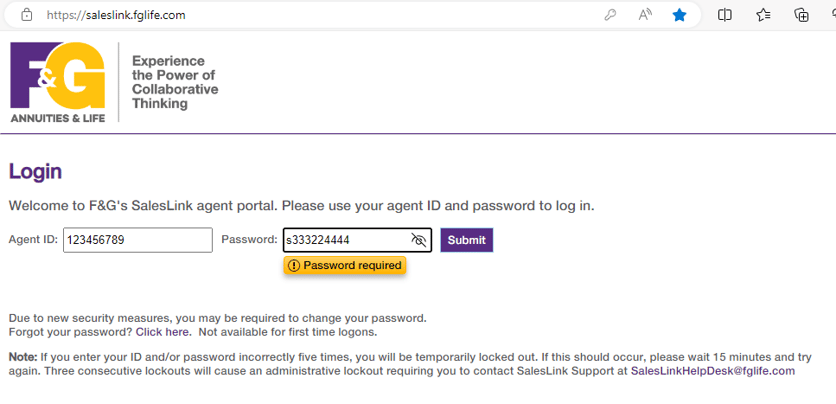

The website will request your nine-digit agent ID. The password is originally set as a lower-case ‘s’ followed by your social security number, no dashes or spaces. Ex. s333224444

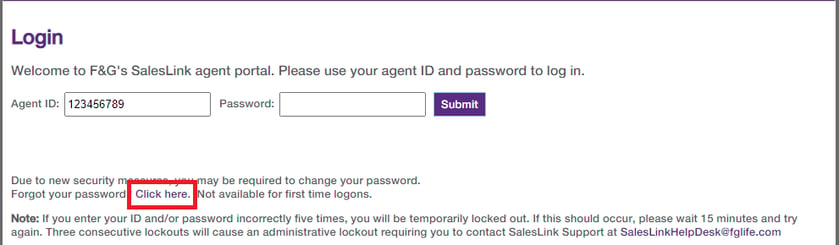

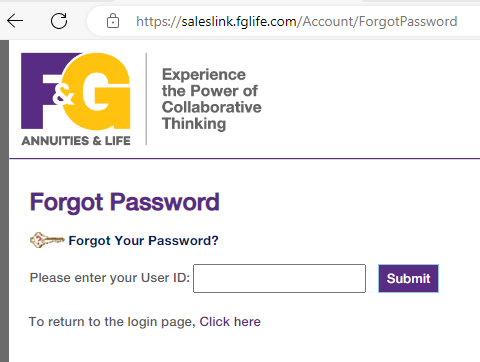

If you're a returning user and have forgotten your password, or if sXXXXXXXXX is not successful look for ‘Forgot your password?’ and select ‘Click here’ in order to reset it.

NOTE: The User ID is your agent ID with F&G. There is not a function for a forgotten user ID.

If you encounter any errors or if you still need assistance logging in feel free to contact the sales support helpline at 800-445-6758. They will be happy to reset any passwords.

NOTE: If your ID or password is entered incorrectly five times, your account will be temporarily locked out. If you are locked out three consecutive times you are required to contact SalesLink Support at SalesLinkHelpDesk@fglife.com.

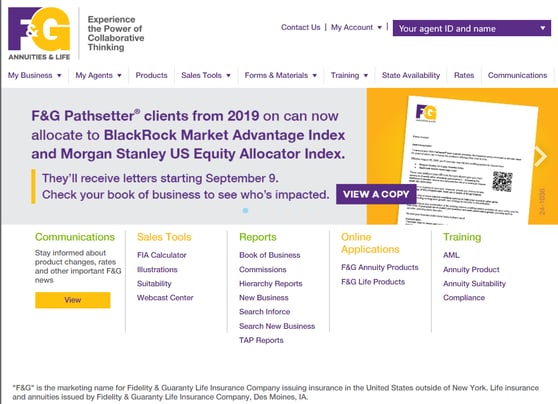

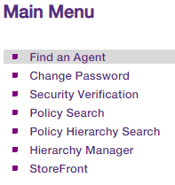

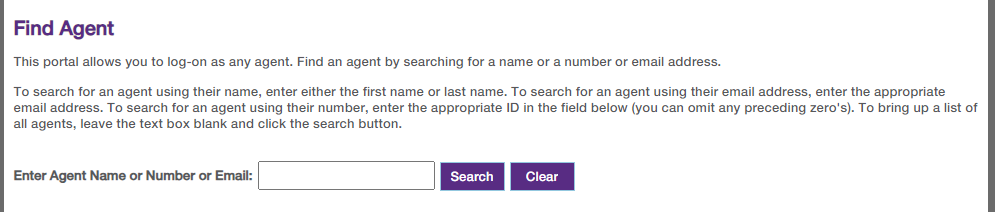

Once logged in you should see a page like this:

You may need to reenter the agent ID number under the 'Find an Agent' option to get to the SalesLink main page.

Upline View of e-App

If you have downline agents, you have the ability to view all of the activity of your downline agents on our e-App platform.

- Log into SalesLink using IMO/upline number. Click on F&G Annuity e-App.

- After confirming the correct agent ID, click NEXT.

- Once logged in, click on All Applications.

- Click on the icon showing blue and green figures in the top left-hand corner, this is the “owner” icon.

- Choose either “All Owners” to see all downline business, or select a specific agent name/agent code to see only that individual’s e-Apps.

- A list will be presented of all e-App activity including saved or submitted applications.

Status Key:

- Complete = All sections complete and application submitted to FGL

- Form Entry = Data entry on application is not complete; Application is not signed or submitted

- Signatures = Data entry on application is complete, and signatures have been requested but not completed; Application has not been submitted

- Locked = Data entry on application is complete and the process of collecting signatures has been initiated but not completed; Application has not been submitted

Suitability Criteria

We know you share our commitment to good sales practices when selling annuity products. An important regulatory requirement is to recommend purchasing, replacement, or exchange of annuity products only if there are reasonable grounds for believing the annuity is suitable.

Appointed producers are required to make every reasonable effort to present each client with the necessary information to make well informed decisions related to the purchase, exchange or replacement of any annuity product.

The Suitability Guide is intended to help you understand what this means and how our company administers suitability requirements. Carefully following this guide will help expedite your application.

Why is suitability so important?

In selling annuity products, it is important that agents assist clients in determining which products are appropriate for their financial situation based on financial needs and objectives as disclosed by the client during the sales process. It is imperative to understand your client’s needs and objectives and provide full disclosure necessary for the client to make well-informed decisions during the sale of annuity products. Full disclosure is not only required by law, but also dictated by our company’s code of ethical conduct to ensure we are always acting in a manner consistent with our clients’ interests.

How exactly does your electronic review process work?

We share our minimum standards to use as guidelines to determine whether an application should be submitted to our company for review. Ensure all questions are completed on applicable forms to prevent a delay in the review. Applications not meeting the below criteria will be declined absent extenuating considerations.

- Approximate Monthly Household Income of at least $1,700 (business decisions made for applicants with significant remaining liquid assets).

- Monthly Household Income to be greater than or equal to Monthly Household Expenses (business decisions made for applicants with significant remaining liquid assets).

- Remaining liquid assets, after purchase of the annuity, to cover at least $20,000. Or, after the purchase of the annuity have remaining liquid assets to cover at least six months of Approximate Monthly Household Expenses, if employed/retired or to cover twelve months of Approximate Monthly Household Expenses, if unemployed.

- Total amount of annuities and life insurance within the surrender period, cannot exceed 75% of Total Assets.

- Applicant must indicate remaining liquid assets are adequate to handle emergencies.

- We don’t allow a reverse mortgage to fund an annuity.

- Applicant may not have an Aggressive Risk Tolerance if the annuity represents a significant percentage of Total Net Worth.

- Surrender charges that are excessive based on the facts and circumstances.

- Anticipated distributions may not be within the surrender charge period unless distributions are surrender charge free or derived from the Guaranteed Minimum Withdrawal Rider.

- A Replacement Comparison Form must be completed on all cases being replaced, this includes internal and external replacements.

- Additional review may be necessary in the event of any replacements made with the last 60 months, provided that the same agent and same set of funds are involved.

- Applications not meeting these criteria will usually be declined. We purposely share the above criteria with you so you know in advance about our minimum standards and can use them in deciding whether an application should be submitted to our company.

- Applications that meet these criteria may be put through an additional screen to determine whether the information on the Suitability Acknowledgement Form raises any other suitability concerns that may require follow up with you or your client.

We reserve the right to change our minimum criteria or escalation guidelines, as we may review and adjust them as necessary at any time. More information may be needed at times to assess if reasonable grounds exist; to determine if based on the client’s financial goals and circumstances, the annuity is suitable.

What happens if an application is denied for suitability reasons?

If an application was declined for suitability reasons, that does not mean the recommendation was necessarily unsuitable. From F&G’s perspective the information supplied does not adequately establish reasonable grounds.

If an application is declined, you will be informed of our decision which will allow you to discuss the matter further with your client. Communication will be sent to your client along with a refund or an explanation that funds have been returned to the transferring company in cases of an exchange. Evaluate the specific circumstances and discuss the matter with your client to determine if other options may be available. Such as a smaller sized annuity or possibly a different product with a shorter surrender period.

Where can I download forms?

Documents and additional tools are also available on SalesLink®

Contact Us

Have additional questions? Visit our agent portal SalesLink® for other training resources.

You can also contact us directly at 800.445.6758 (Option 1) from 7 a.m. to 5 p.m. or via email.

Email us at casemanager@fglife.comWiki Help Page

What is a Wiki?

A Wiki is a web application that allows collaborative modification of its content and structure. We have taken our support documents for the annuity e-applications and posted them into this one collaborative platform.

Do I need to sign up for an account to use the F&G Wiki?

No, anyone with a web browser and Internet connection can access information in this Wiki. Some links on the Wiki site will require SalesLink access to view additional content.

What if I have a question that is not answered here?

You can contact us at the following number for additional assistance:

-

1-800-445-6758 - Option 1, Option 1 for new business, application submission and general illustration questions from 7 a.m. to 6 p.m. CT

-

Questions related to pending new business and application submissions can also be emailed.

Send an email to casemanager@fglife.com